Alternative Energy/Country AE Profiles: Difference between revisions

AClearwater (talk | contribs) |

AClearwater (talk | contribs) |

||

| Line 98: | Line 98: | ||

===Global Market Share=== | ===Global Market Share=== | ||

===Most representative companies=== | ===Most representative companies=== | ||

[Image:Goldwind Market Share.jpg] | |||

"Goldwind (Jinfeng) has recently emerged as the leading Chinese wind turbine | "Goldwind (Jinfeng) has recently emerged as the leading Chinese wind turbine | ||

manufacturer. A Chinese company, Goldwind currently holds 2.8 percent percent of market | manufacturer. A Chinese company, Goldwind currently holds 2.8 percent percent of market | ||

Revision as of 10:18, 1 May 2009

China

General Information and Introduction

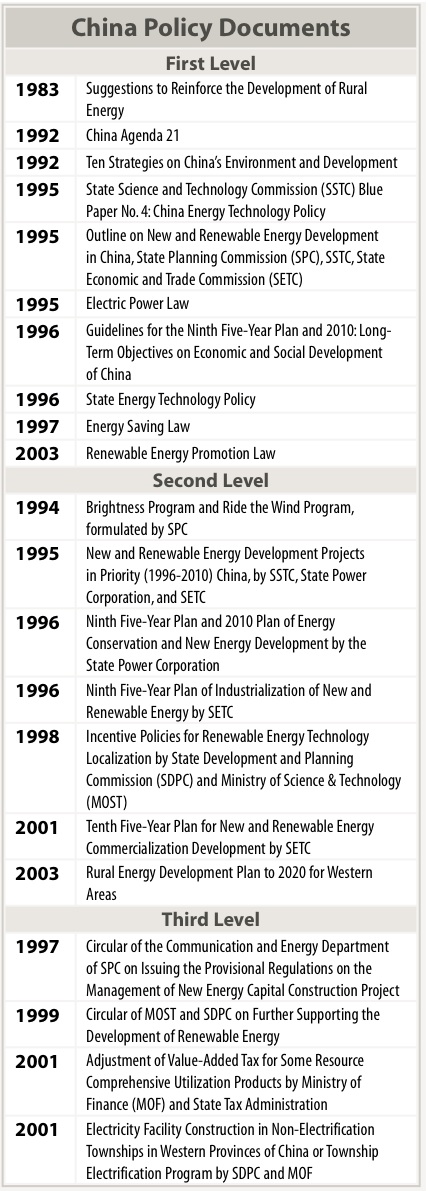

The US National Renewable Energy Laboratory categorizes China's alternative energy into three categories. First level policies provide general direction and guidance. Second level policies provide goals and development plans. These policies provide direction to national alternative energy efforts. Third level policies provide specific regulations and incentives.

READING: Renewable Energy Policy in China: Overview National Renewable Energy Laboratory http://www.nrel.gov/docs/fy04osti/35786.pdf

- China’s Center for Renewable Energy Development

- drafting a new lawâ Renewable Energy Development and Utilization Promotion Law goals of the law

- "synthesize basic principles of the market economy and the political objectives of energy security"

- provide incentives to encourage development of renewable technologies

Addition Sources I am investigating:

- A Comparison of Wind Power Industry Development Strategies in Spain, India and China

- Joanna I. Lewis

- July 19, 2007

- Prepared for the Center for Resource Solutions

- http://www.resource-solutions.org/pub_pdfs/Lewis.Wind.Industry.Development.India.Spain.China.July.2007.pdf

- Designing a Renewables Portfolio Standard: Principles, Design Options, and Implications for China

- Dr. Jan Hamrin, Dr. Ryan Wiser, Seth Baruch

- Center for Resource Solutions

- http://www.resource-solutions.org/pub_pdfs/IntPolicy-Final_RPS_Options.pdf

- Energy for the 21st century

- By Roy L. Nersesian

- Armonk, N.Y. : M.E. Sharpe, c2007

- Available at: http://books.google.com/books?id=LQSCHNH_TM4C&printsec=frontcover

- Handbook of energy efficiency and renewable energy

- By Frank Kreith, D. Yogi Goswami

- page 2-29

- Available at: http://books.google.com/books?id=OfiMKyFV8JIC&printsec=frontcover&source=gbs_summary_r&cad=0

- Renewable Energy Business Partnerships in China: Renewable Energy in China

- April 2004

- http://www.nrel.gov/docs/fy04osti/35785.pdf

- Fueling China's Development Through Renewable Energy

- by D Lew - 2001

- http://www.nrel.gov/docs/fy01osti/30879.pdf

- Renewable Energy Policy in China: Financial Incentives

- April 2004

- http://www.nrel.gov/docs/fy04osti/36045.pdf

- Wikipedia: Energy policy of China

- Archive of 2006 NREL Website: Energy Efficiency and Renewable Energy Technology Development in China

- http://www.martinot.info/china.htm

- Many Links to other sources

- China Policy Framework to Support Renewable Energy Development

- LI JunFeng, GAO Hu

- Energy Research Institute (ERI) under National Development and Reform Commission (NDRC)

- http://www.martinot.info/Li_Gao_GWREF2006.pdf

- China Policy Framework to Support Renewable Energy Development

- Many Links to other sources

- The China Renewable Energy Program:

- China’s Renewable Energy Law is among the most aggressive in the world. Well implemented, the law could catalyze renewable energy markets and production on an unprecedented scale.

- http://www.efchina.org/FProgram.do?act=list&type=Programs&subType=3

- The World Bank: Toward a Greener China

- http://web.worldbank.org/WBSITE/EXTERNAL/COUNTRIES/EASTASIAPACIFICEXT/CHINAEXTN/0,,contentMDK:21644195~pagePK:141137~piPK:141127~theSitePK:318950,00.html

- The Renewable Energy Development Project (promoted the development of a sustainable photovoltaic (PV) market)

- http://web.worldbank.org/WBSITE/EXTERNAL/COUNTRIES/EASTASIAPACIFICEXT/CHINAEXTN/0,,contentMDK:21630705~menuPK:3949495~pagePK:1497618~piPK:217854~theSitePK:318950,00.html

- Project focus on rural areas

- "Supported the sale of solar systems to approximately 400,000 rural households and institutions in the provinces of Qinghai, Gansu, Sichuan, Yunnan and Sha'anxi, and in the Autonomous Regions of Inner Mongolia, Xinjiang, Xizang and Ninxia."

- "The World Bank provided $13 million in loan financing while the GEF provided $27 million in grants. The total project cost was $205 million."

- World Bank, GEF-Backed Energy Efficiency Program Expands in China

- http://web.worldbank.org/WBSITE/EXTERNAL/NEWS/0,,contentMDK:21610830~pagePK:64257043~piPK:437376~theSitePK:4607,00.html

- Energy management companies: ESCOs

- "ESCOs use innovative energy performance contracts to finance energy efficiency projects that save money on fuel or electricity."

- "The companies are paid a large percentage (usually 80 percent) of the estimated cost savings until their investments are paid off-typically in one-to-three-years. With the investments paid from the savings, the host enterprises receive more efficient equipment to use for years to come with no cash outlay."

- In Search of Clean Energy to Meet China's Needs

- http://web.worldbank.org/WBSITE/EXTERNAL/COUNTRIES/EASTASIAPACIFICEXT/CHINAEXTN/0,,contentMDK:21589744~pagePK:141137~piPK:141127~theSitePK:318950,00.html

- "The Bank's focus shifted from financing large infrastructure projects and institutional reforms in the 1980s and 1990s to smaller, more innovative projects. "Our lending amounts have dropped but we do a lot of innovative, complicated projects now," says Zhao Jianping, the World Bank's energy sector coordinator in Beijing."

AE Capacity or Output

How much AE impacts in GIP

Governmental Policies

Governmental Incentives and Funding Structure

Governmental Laboratories and Research Institutes

Research focus

- Chinese solar PV manufacturing companies are planning to lead the world with production rising from 350 MW in 2005 to 1500 MW in 2007. (Weiss & Bonvillian 2009, 68)

Most representative companies

[Image:Goldwind Market Share.jpg] "Goldwind (Jinfeng) has recently emerged as the leading Chinese wind turbine manufacturer. A Chinese company, Goldwind currently holds 2.8 percent percent of market share in global wind turbine sales, reaching the top 10 for the first time in 2006." (Lewis, 2007)

Patents (number and types)

AE Focus

Funding Sources

Most amazing information in AE

Denmark

General Information and Introduction

AE Capacity or Output

How much AE impacts in GIP

Governmental Policies

Governmental Incentives and Funding Structure

Governmental Laboratories and Research Institutes

Research focus

Most representative companies

Patents (number and types)

AE Focus

Funding Sources

Most amazing information in AE

Germany

General Information and Introduction

"Renewable energy technologies have deployed rapidly in Germany since 1990 largely as a result of energy policies adopted by the German government and the European Union. For example, installed wind capacity has grown by more than 2000% since 1990, biomass by more than 500%, and solar photovoltaic installations by more than 15,000%. While the 1990 baseline for each of these technology areas was very low, the steady rise of renewable energy in Germany is noteworthy nonetheless."[1] Germany has set the bar in terms of use of alternative energy technology, and the amount of energy produced from this technology as a share of total electrical output. In 2007, 14.2% of Germany’s electricity supply was from renewable sources. Wind power led the way, producing 39,500 GWh that year, which was 6.4% of Germany’s electricity consumption, almost half of the 14.2% total. Germany is the world leader in solar energy capacity and second to the US in wind energy capacity, with approximately 1.2 GW and 23 GW of installed capacity, respectively. In 2007, Germany’s overall avoided emissions of CO2 were approximately 127 million tons. These positive developments were enabled by the German government’s consistent support of its alternative energy subsidy program, the Feed-in Tariff, since its inception in 1990. (Bohme and Durrschmidt 2008)

AE Capacity or Output

- Germany produced a total of 87,450 GWh of alternative electricity in 2007 (14.2% of the total electricity supply). The technologies that produced this energy are as follows:

- Wind - 39,500 GWh

- Hydropower - 20,700 GWh

- Biomass - 14,230 GWh

- Bio/sewage/landfill gas - 9,520 GWHh

- Solar PV - 3,500 GWh

- Geothermal - 0.4 GWh

- Tidal/Wave - n/a

(Bohme and Durrschmidt 2008, 12)

How much AE impacts in GIP

Governmental Policies

Germany's main alternative energy support policy is a Feed-in Tariff (FIT). This policy supports alternative energy by offering competitive fixed prices in long-term contracts for electricity from wind, solar, geothermal, biomass, hydropower, and biogas. The contracts are made with alternative energy producers, which is anybody who owns a facility operating the technologies listed above and feeding into the electrical transmission grid. There is no cap on the number of contracts that can be awarded each year for the eligible technologies. The German FIT contracts are set for 20 years. This allows development of alternative energy plants to move forward with guarantees of:

- A competitive price

- A long-term contract

- Interconnection to the electricity grid at no cost to the developer

- The utility’s purchase of all electricity that the renewable power plant produces

The FIT policy creates a market for the alternative energy technologies by making it profitable for individuals, communities and developers to invest in alternative energy projects. The policy does not invest directly in R&D for these technologies, but encourages competition between the companies that produce the technology to make cheaper and more efficient products.

Governmental Incentives and Funding Structure

"Germany has gradually increased the emphasis on renewable energy deployment programs (the FIT) in its energy and technology policy portfolio. Increasingly, governments have shifted their attention from basic and applied research programs since the early 1990s and devoted more resources to deployment incentive programs. While this application-oriented shift in emphasis has resulted in the more rapid growth of renewable energy industries and in the commercial deployment of many existing renewable energy technologies, these gains may be purchased at the expense of longer-term R&D programs. Government expenditures for renewable energy market conditioning and deployment incentives exceeded total government energy R&D expenditures by more than 200% in 2002."[2]

"While the evolution of the German approach demonstrates a clear trend toward deployment-based activities, there is little evidence on the implications of this focus on technological advance. Since the advance of renewable energy technologies is a function of many variables, including spillovers from the private sector and from R&D programs in other countries, research efforts have not yet established the relative significance of individual factors for technological advance." Ibid.

Governmental Laboratories and Research Institutes

- DLR - The German Aerospace Center

- "The goals of energy research at DLR are to further develop solar-thermal power-plant technologies through to the market introduction phase, make low- and high-temperature fuel cells usable, particularly for generating electricity, and to research and develop high-efficiency gas and steam turbine power plants." [3]

- EUREC Agency - European Renewable Energy Centres Agency

- "Our 43 members are prominent research and development (R&D) groups spread across Europe, operating in all renewable energy technologies (wind, biomass, small hydro, marine, geothermal, photovoltaics, solar thermal electricity, solar thermal heating and cooling and solar buildings). Our members also conduct research into supporting technologies such as energy efficiency, storage, distribution and integration, while others study the social and economic aspects surrounding renewable energy."[4]

- creates strong links with the renewable energy industry, fostering contacts and cooperation between members and their counterparts in the industry. These links contribute to define comprehensive R&D strategies, and should facilitate innovation and technology transfer through the promotion of R&D results.

- EUREC's ProRETT program:

- "The ProRETT project proposes an innovative and structured methodology for quicker and larger exploitation of existing scientific RTD results in the fields of renewable energy and energy efficiency in the form of licensing and spin-off creation in Europe."[5]

Research focus

By 2010, German alternative energy technology manufacturers are predicted to have a world market share of 4% - 5%. This is predominantly wind and solar technology companies, more so than other technologies. Ibid.

- In 2006, 4 German wind turbine manufacturers accounted for ~29% of the wind market globally.

- Germany is the #1 market for solar technology with 2,530 MW of installed capacity (Weiss & Bonvillian 2009, 67)

- German solar companies are planning on investing over 2.6 billion euros by 2010 in the technologies

Most representative companies

German Wind Turbine Manufacturers in 2006

- Enercon 15.4% - #4 globally

- Siemens 7.3% - #6 globally

- Nordex 3% - #7 globally

- Repower 3% - #8 globally

Germany's Solar Technology Manufacturers:

- Q-Cells -#1

Patents (number and types)

AE Focus

Funding Sources

Most amazing information in AE

Spain

General Information and Introduction

Spain is a close second to Germany in its adoption of alternative energy, and a great deal of that development can be attributed to its Feed-in Tariff (FIT), which, similar to Germany's, encourages rapid adoption of alternative energy technologies by guaranteeing a premium or fixed price in a 20 year contract for the electricity produced. Spain differs from Germany in that it offers two options for the FIT price. The premium price is set at the yearly average market price for electricity with an additional premium added on top. This premium guarantees a positive return on investment for the entity who pays for the new alternative energy plant. The other option is a fixed price like Germany's that guarantees the same price, set based on the per kWh cost of generation for that type of alternative energy technology, for 20 years.

AE Capacity or Output

While Germany still holds the top spot globally in terms of total installed solar PV capacity, as of 2008 Spain leads the world in added solar PV capacity at 1.7 million kW. Germany is in second place with 1.5 Million kW added, the US is a distant third with 300,000 kW added and Japan holds the fourth spot with 240,000 kW added.

"The big difference between the top two countries and the U.S. and Japan appears to be public policy. In Germany and Spain, power companies are required to make long term purchases of renewable energy at uniform prices. Although similar requirements exist in the U.S. and Japan, they are so small that they lead to policy failure, which in turn prompts legislators to be apprehensive when it comes to strengthening those policies."[6]

Spain holds the third spot globally for installed wind power capacity at 16,740 MW by the end of 2008.[7] Only the US and Germany have more installed wind capacity. The total output of Spain's wind turbines that year was 31,400 GWh.

How much AE impacts in GIP

Governmental Policies

"The procedure developed by the Spanish Government to promote, not only solar heating and cooling activities, but the whole spectrum of renewable energies is the Program for Promotion of Renewable Energies 2005-2010 (PPER or PFER in Spanish). Revised version of PFER 2000-2010, the strategic target of PFER is to achieve by 2010 a 12% of primary energy consumption by renewables, through a joint combination of subsidies, tax exemptions and feed-in-tariffs for electricity production."[8]

Governmental Incentives and Funding Structure

Spanish alternative energy R&D programs:

"The National Plan for Research, Development and Innovation is the Spanish mechanism to establish the objectives and priorities on research, development and innovation (R&D&I) as well as to design the necessary tools that guarantee their achievement in the short and medium-term. While in past years the corresponding Plans were based on thematic subjects, this time the National Plan R&D&I 2008-2012 is based on the definition of model instruments to reach the strategic objectives fixed by the National Strategy for Science and Tecnology (ENCYT, EstrategÃa Nacional de Ciencia y TecnologÃa). Between the available instruments, the Projects for Applied Research and the Projects for Experimental Development may be applied to sectors like:

Energy and Climate Change, which includes development of distributed power generation, transmission, storage and active distribution and off-shore wind energy plants

Nanotechnology, New Materials and new Industrial processes, which includes materials and coatings with special optical, electric and magnetic features and advanced materials for the absorption of energy (acoustic, thermal, electromagnetic, etc.)"[9]

- Projects for Applied Research: 22 M⬠in subsidies and 132 M⬠in loans

- Projects for Experimental Development: around 31 M⬠in subsidies and around 294 M⬠in loans Ibid.

Governmental Laboratories and Research Institutes

IDEA [10] - The Instituto para la Diversificación y Ahorro de la EnergÃa (Institute for Diversification and Saving of Energy)

- a state-owned business entity that reports to the Ministry of Industry, Tourism and Trade through the General Secretariat for Energy.

- In charge of: Royal Decree 2/2007, 21 January 2003, amending Royal Decree 1432/2003, 21 November 2003, regulating the issuing of report on the fulfilment of the scientific and technological requirements, for the purposes of applying and interpreting tax deductions for research, development and technological innovation projects.

Research focus

In 2006 Spain manufactured 132.3 MW of solar PV, which is 1% - 2% of the world manufacturing capacity. [11]

Most representative companies

- Gamesa - Wind

- Acciona - Wind

- Abengoa - Solar

- Iberdrola - Wind