Diagnostic Kits/Give an overall picture of the Kits' sector: Difference between revisions

m (→Regulation) |

|||

| Line 12: | Line 12: | ||

==What are the main business models?== | ==What are the main business models?== | ||

=== Regulation === | === Regulation === | ||

[[Image:US System of Oversight of Genetic Testing p247 - 2008 SAGCHS.png| | [[Image:US System of Oversight of Genetic Testing p247 - 2008 SAGCHS.png|thumbnail|1000px| | ||

U.S. System of Oversight of Genetic Testing: A Response to the Charge of the Secretary of Health and Human Services, Report of the Secretary’s Advisory Committee on Genetics, Health, and Society, April 2008. pg.247]] | U.S. System of Oversight of Genetic Testing: A Response to the Charge of the Secretary of Health and Human Services, Report of the Secretary’s Advisory Committee on Genetics, Health, and Society, April 2008. pg.247]] | ||

Revision as of 09:45, 2 October 2009

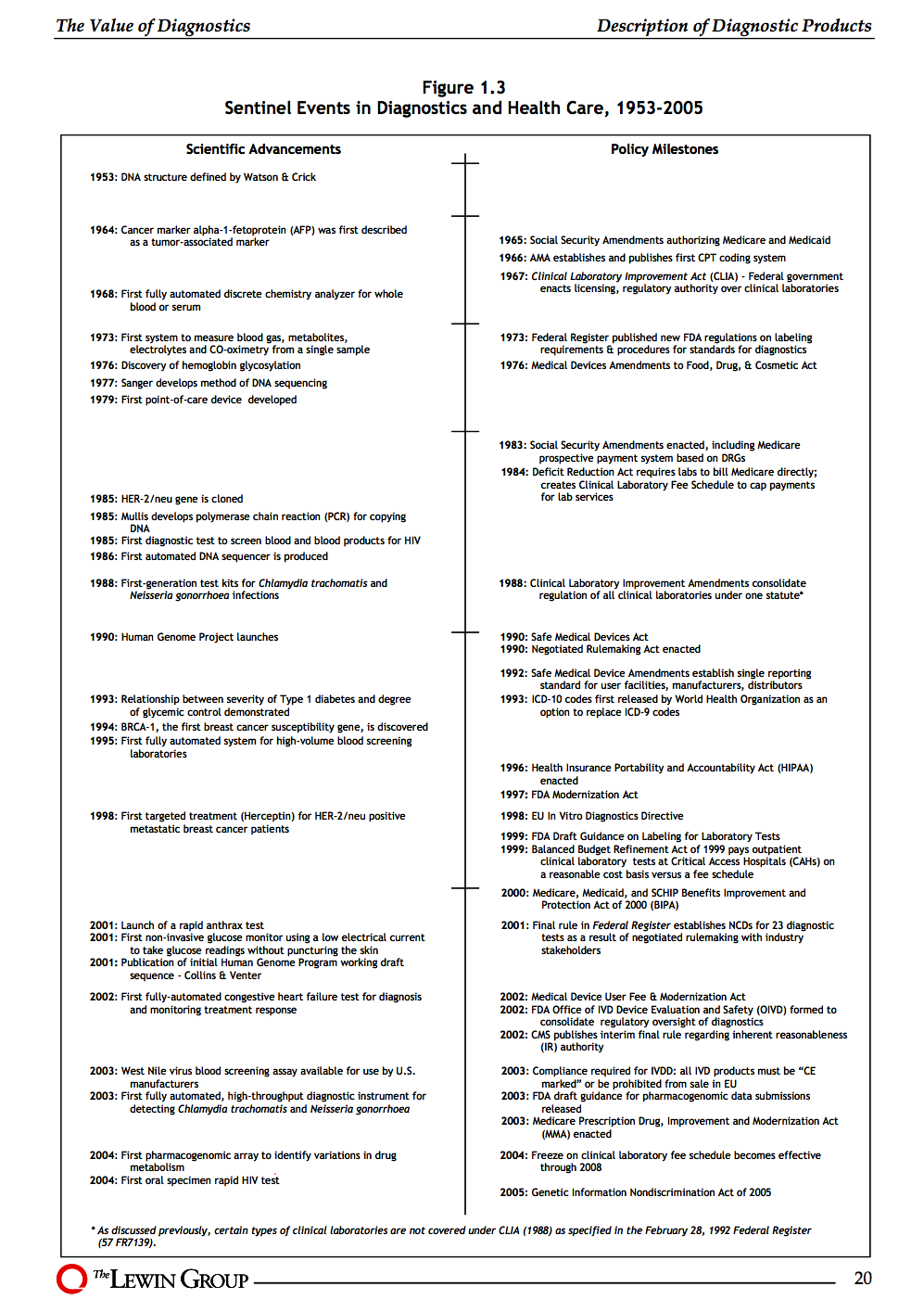

Many of these questions can be answered from data in the The Value of Diagnostics report (caution: sponsored by AdvaMed), starting with the Profile of the Diagnostics Industry section.

background: To quantify the Diagnostic Kit Market, we must start with a working definition. When we say Diagnostic Kit, we mean the In-Vitro Diagnostics (IVD), and so we are actually interested in the IVD Market, which encompasses products that produce clinical data from a sample of tissue taken out of a patient (note that other diagnostic products such as medical imagers and in-vivo diagnostics are not included).

IVDs can be categorized based on the location of testing. The vast majority of routine tests are performed in-house hospital labs or in reference labs. These tests may be supplied as a complete kit to the testing laboratory or may be developed in-house with Analyte Specific Reagents (ASRs). ASR-based diagnostics are interesting because the ASRs are sold alone, without specific testing procedures, instructions, or supporting materials. Instead of purchasing a complete kit, labs (which must be CLIA high-complexity certified) purchase just the ASR and develop their own tests around it. Lastly, some kits are available directly to consumers over-the-counter. Of these, some can be operated in the home, such as pregnancy tests and blood glucose tests, while others require the user to ship a sample to a remote reference lab. DNA Direct is a company that operates in this space, providing gene-based OTC diagnostic kits that are evaluated in a remote lab.

How was this field born and how is it evolving?

What are the main business models?

Regulation

What are the innovation dynamics in this field? (inputs/outputs, timing of innovation/ disruptive or incremental innovation?)

How does knowledge flow in this field?

Is this field replicating models from other fields?

How many companies?

Diagnostic Kit Manufacturers

Diagnostic laboratories

Hospital Labs

References labs

"The major national reference labs including Quest, LabCorp, Specialty/Ameripath, Mayo and others account for at least 60% of the market for esoteric test services. The remaining 40% is shared by a group of some 3000 small, local market laboratories. The major reference labs have built a comprehensive menu of specialized test services and continue to expand their offerings via collaborations with leading medical research centers. They offer a huge presence in the market and manage distribution networks that touch just about every medical specialty. Thus many CLIA-registered company sponsored test services avail themselves of the marketing resources offered by the national reference labs."

- CLIA labs offering ASR-based diagnostics:

"In 2002, nine companies accounted for 78% of the US diagnostics market" - The Value of Diagnostics pg. 53, referencing Quirk WR. The in-vitro diagnostics industry: overview and emerging opportunities. Toronto, Canada: RBC Capital Markets, 2003. (ref kalorama)

"In 2002, nine companies accounted for 78% of the US diagnostics market" - The Value of Diagnostics pg. 53, referencing Quirk WR. The in-vitro diagnostics industry: overview and emerging opportunities. Toronto, Canada: RBC Capital Markets, 2003. (ref kalorama)

- Roche: 22%

- Abbott Labs: 11%

- J&J: 9%

- Gen-Probe: 8%

- Beckman C: 6%

- Becton D: 6%

- Dade Behring: 6%

- Bayer: 5%

- BioMerieux: 5%

- other: 22%